PAN (Permanent Account Number)

PAN (Permanent Account Number) card is a unique 10-digit alphanumeric identity card that is issued to individuals and entities in India by the Indian Income Tax Department. PAN card serves as an important proof of identity and is mandatory for several financial transactions such as opening a bank account, filing income tax returns, and investing in the stock market, among others.

The PAN card contains information such as the cardholder’s name, photograph, date of birth, and PAN number. It is important to keep the PAN card safe and secure as it cannot be replaced, only a duplicate PAN card can be issued if the original card is lost or damaged.

How to Change PAN Card Details ?

There may be mistakes in your name, surname, middle name, parent’s name like father or mother or date of birth, mobile number, when your PAN card is printed. There may be changes in your address, city, state or name after your PAN card is issued. In such cases, your name, parents name, address or birth date must be changed and updated on your PAN card. The PAN card details can be changed online or offline.

How to update PAN card online?

To update your PAN card online, you can follow the steps mentioned below

You can update PAN card details online through the NSDL e-Gov website and UTI Infrastructure Technology And Services Limited (UTIITSL)

How to update a PAN card on NSDL e-Gov portal ?

NSDL stands for National Securities Depository Limited, which is one of the two central depositories in India that provides depository services. NSDL also provides services related to PAN (Permanent Account Number) cards, such as the issuance of new PAN cards, corrections in existing PAN data, and reprinting of PAN cards.

To apply for a new PAN card through NSDL, you can follow these steps:

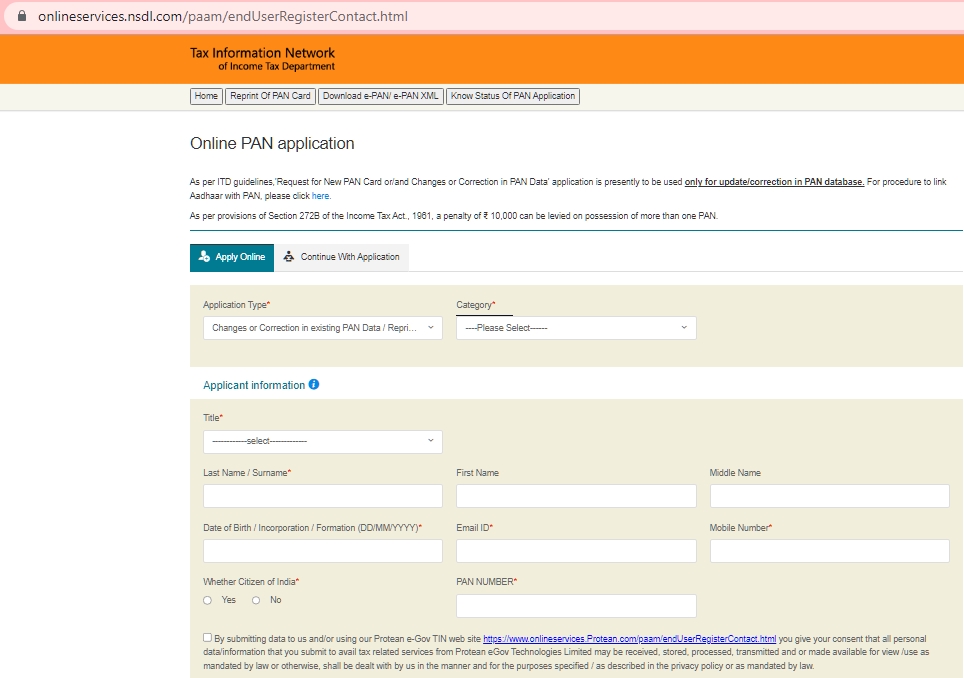

- Step one: visit NSDL website https://www.onlineservices.nsdl.com/paam/endUserRegisterContact.html

- Step two : You will now have to fill up this Online PAN Application. see how to fill all the particulars.

- Application type: for New pand card (49A) and Changes or Correction in existing PAN Data / Reprint of PAN Card

- Category: Select the relevant category from the drop-down menu. If you do not have a business and are filing your income tax return.

- Other details: Fill in other personal details like:

- Title

- Last Name /Surname

- First Name

- Middle Name

- Date of Birth / Incorporation / Formation

- Email ID

- Mobile Number

- Citizenship (Indian or not)

- PAN number

- Type in ‘Captcha Code’ and tap on ‘Submit’.

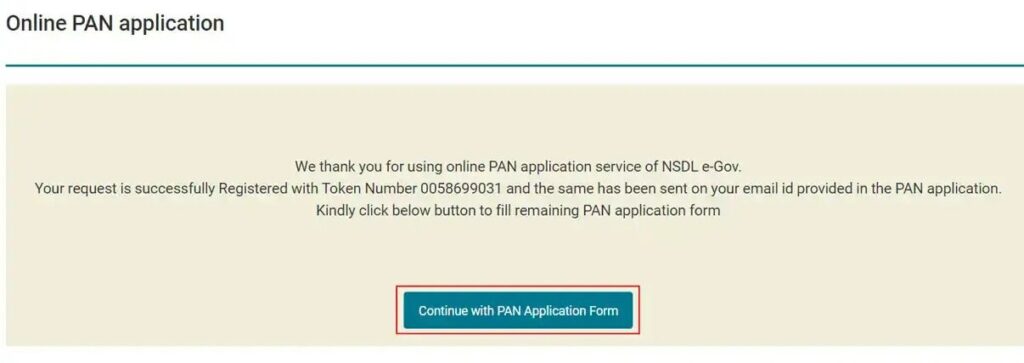

Step three : after your press the submit button . you will receive a Token Number on the Email ID provided here.

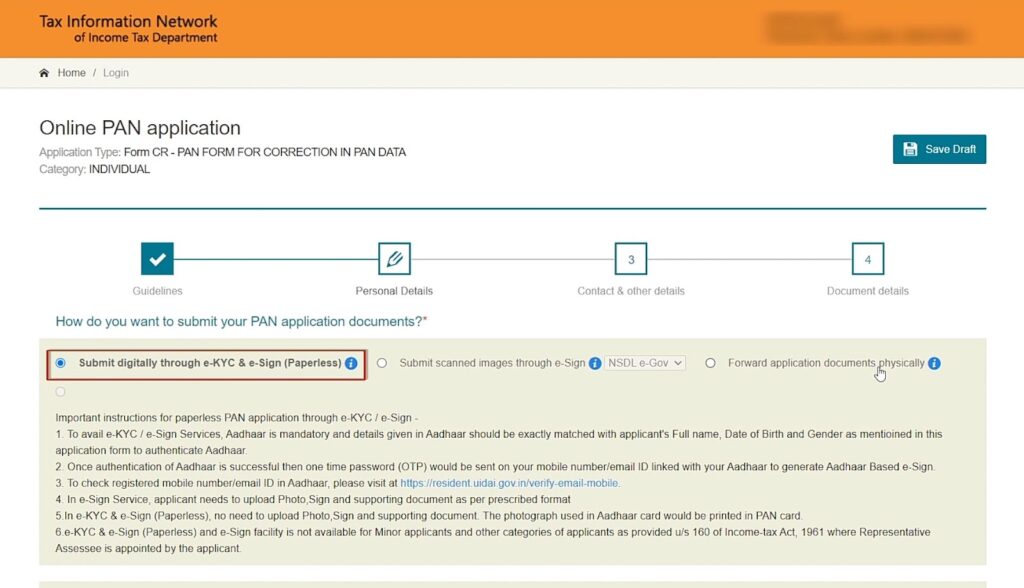

Step four : after your press the continue button . you will three option below

- Submit digitally through e-KYC & e-Sign (Paperless)

- Submit scanned images through e-Sign

- Forward application documents physically

To complete the entire process digitally online through Aadhaar OTP, based please select the first option ‘Submit digitally through e-KYC & e-Sign (Paperless)’ for updating your PAN.

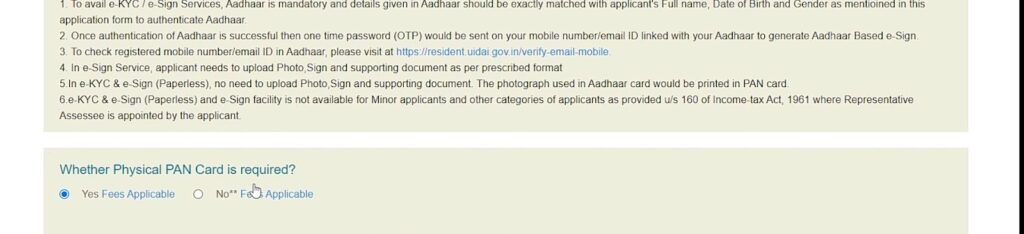

Step Five : If you want a new physical copy of the updated PAN card to your residence address, select yes. amount charges will be applicable.

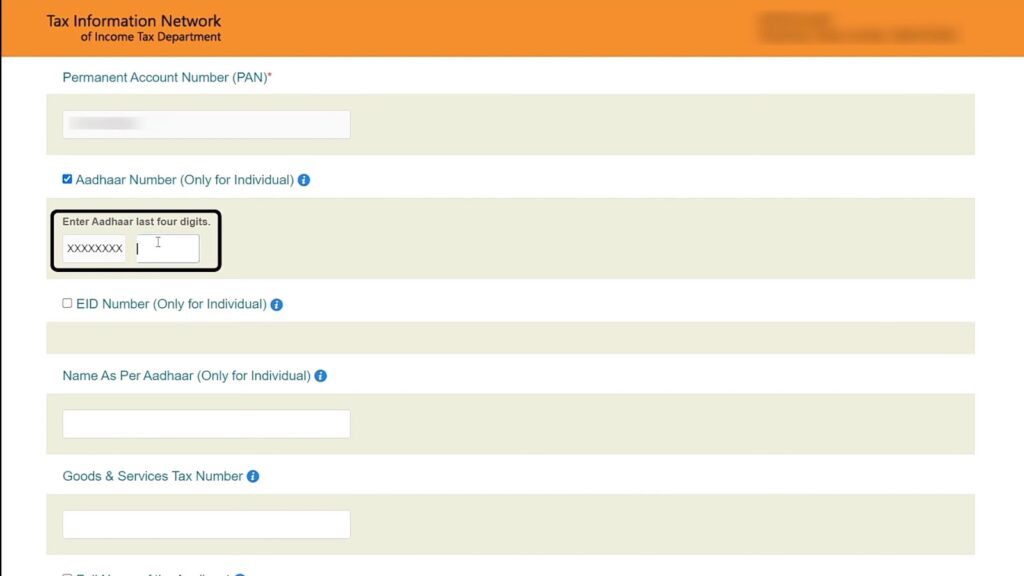

Step SIX : Scroll down and enter the last four digits of your Aadhaar number for further process.

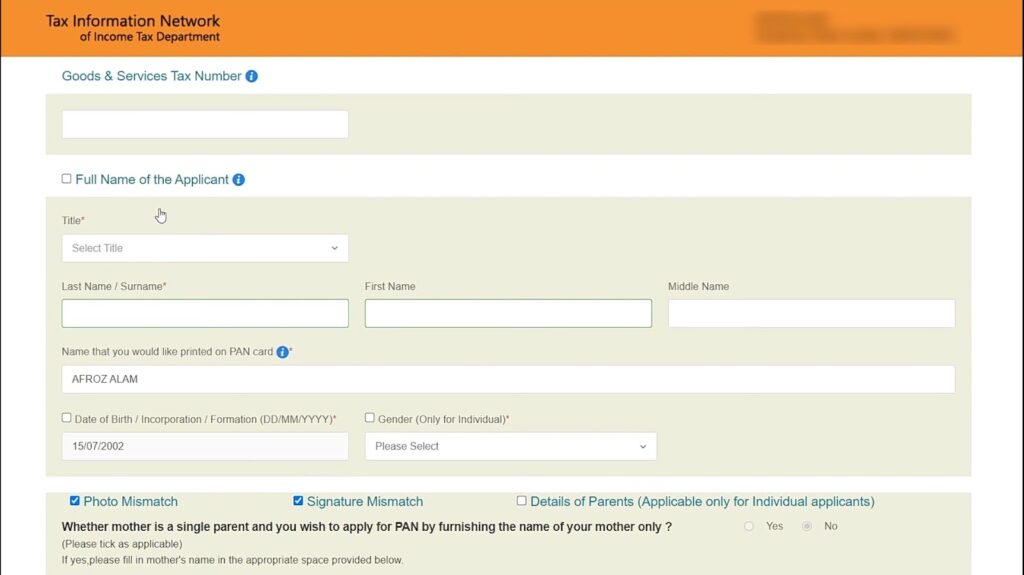

Step SEVEN : Scroll down and update the required details. tick the relevant box for which correction or update is required. After filling up, click on ‘Next’ to proceed to the page ‘Contact and other details

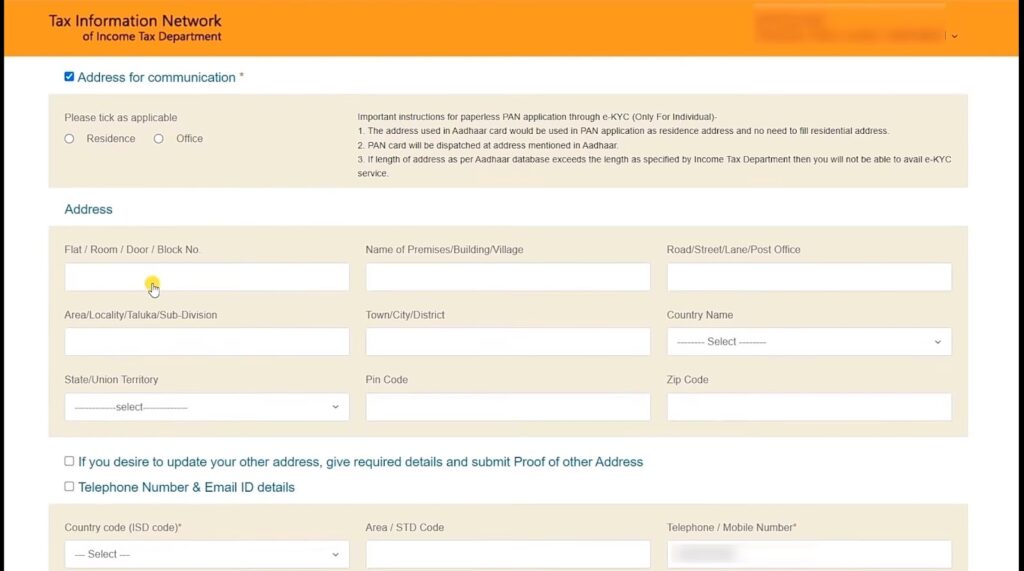

Step eight : enter the new address which is to be updated and proceed to the next page.

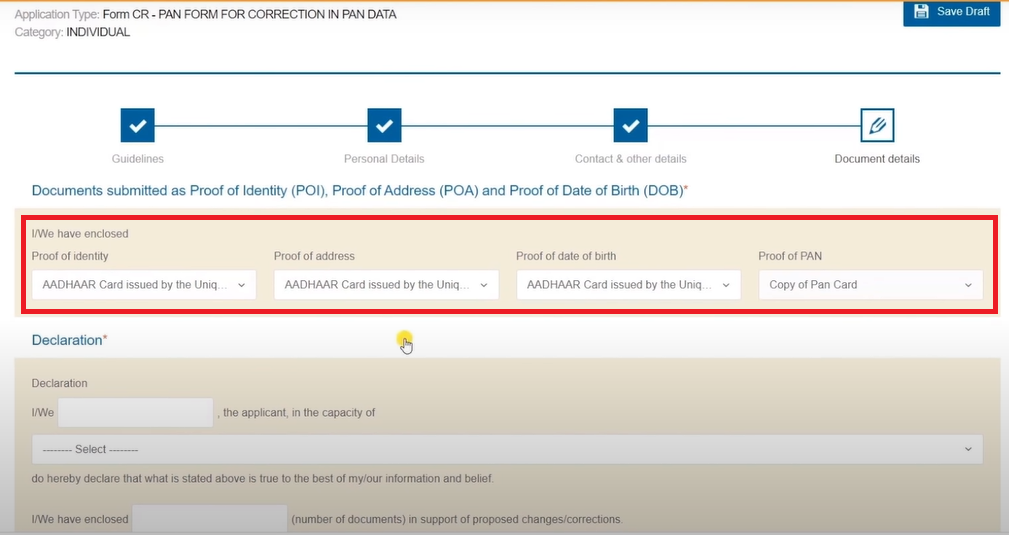

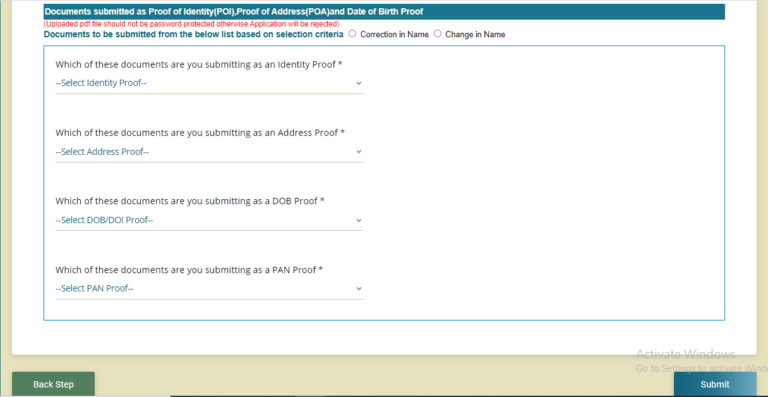

Step Nine : Based on the particular data you have updated, attach the proof document along with a copy of PAN.

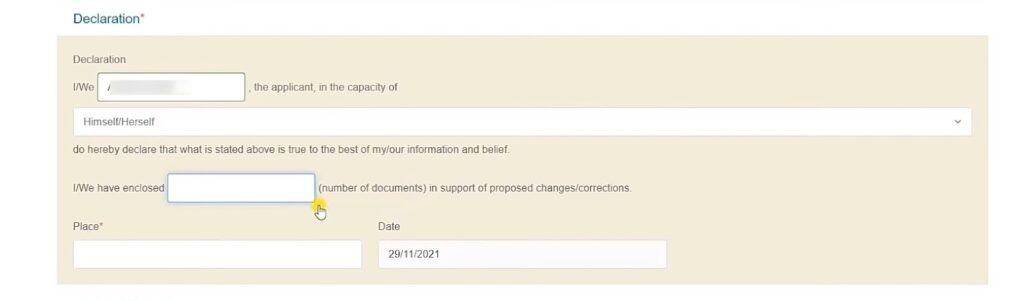

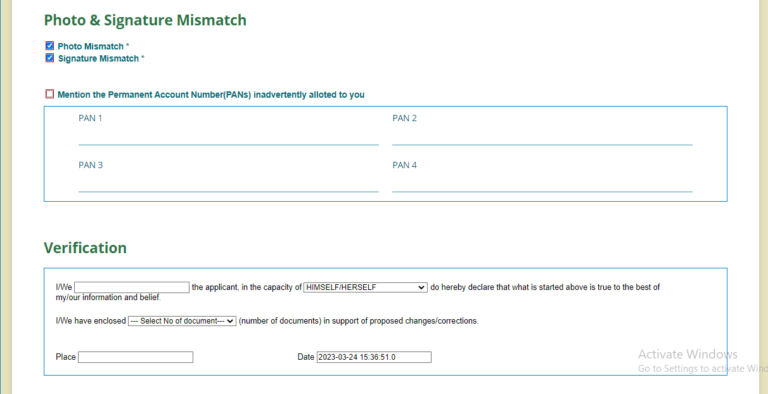

Step 10 :In the declaration section

- Mention your name,

- Declare that you are submitting the form in your own capacity, i.e. select ‘Himself/herself’,

- Enter your place of residence.

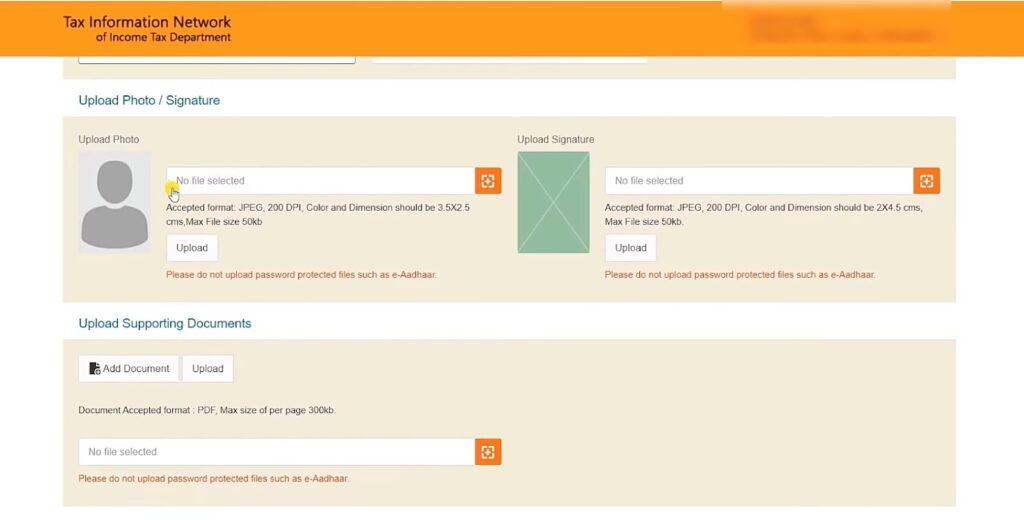

Step 11 : after that attach a copy of your ‘photograph’ and ‘signature’. Ensure the files are as per the specifications and sizes mentioned. Once done, click ‘Submit’.

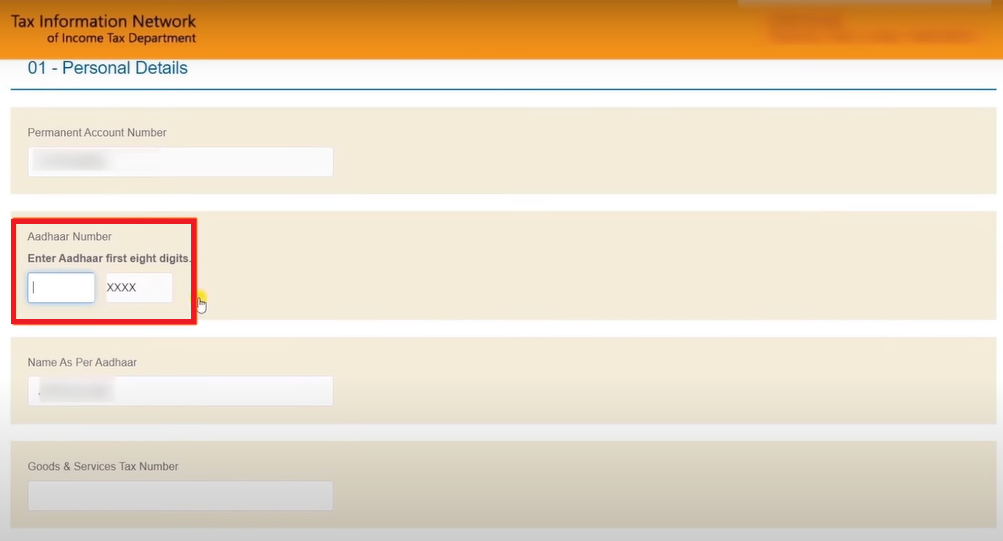

Step 12 : You will now see a preview of the form. Enter the first eight (8) digits of your Aadhaar Number and ensure all other details filled in by you are correct. and submit now

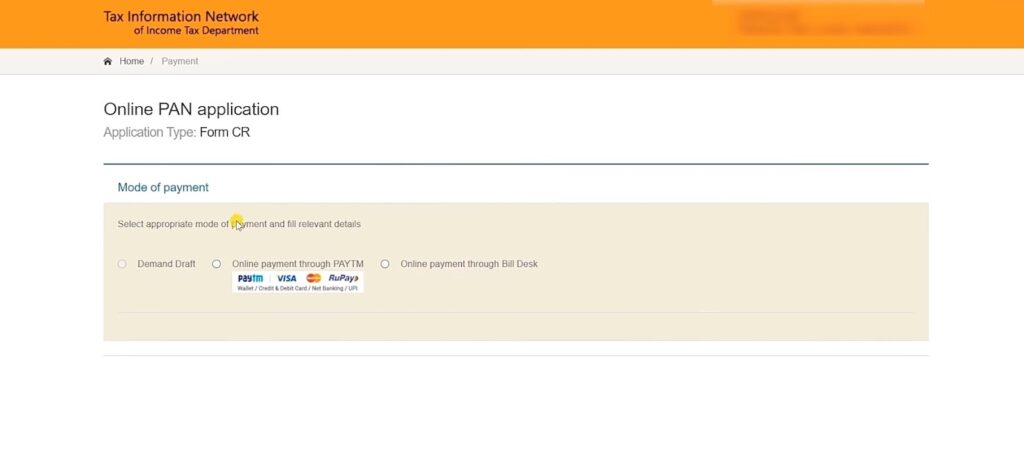

Step 13 : After submitting the PAN card correction form, the payment page will appear. Payment can be done through various payment gateways. After successful payment, you will receive a payment receipt. submit now

Step 14 : To complete the PAN card update/correction process, click ‘continue’. You will now have to complete the KYC process. Select the check box to accept the terms and conditions and click on ‘Authenticate’.

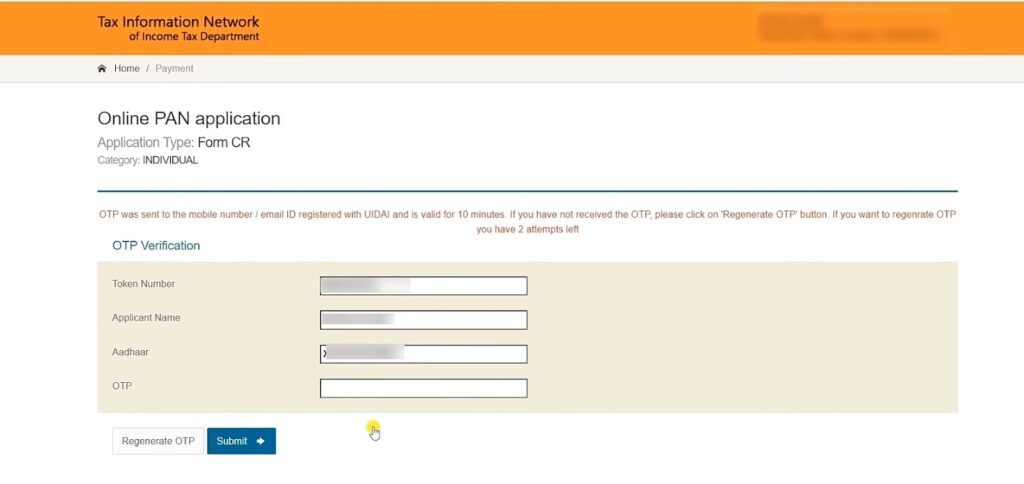

Step 15 : An OTP will be generated and sent to your Aadhaar Registered mobile number. Enter the OTP and submit the online PAN application form.

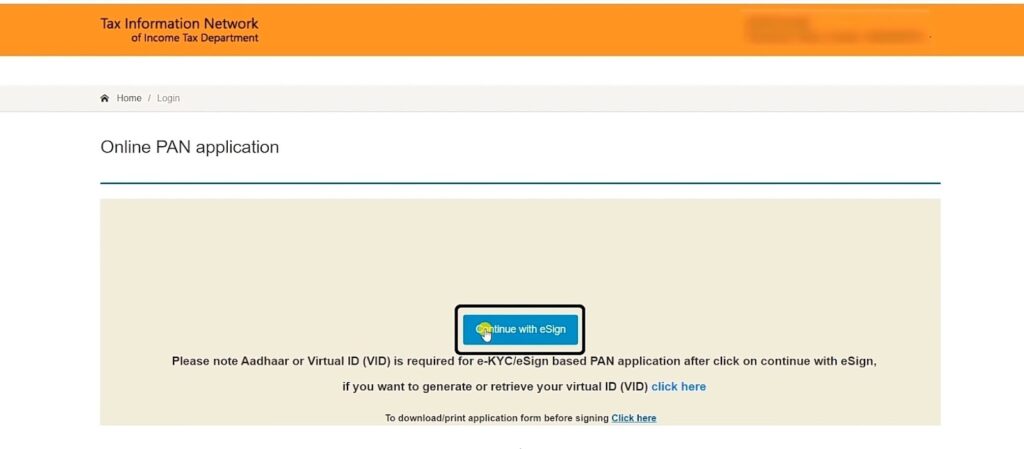

Step 16 : On the next screen, click on continue with eSign.

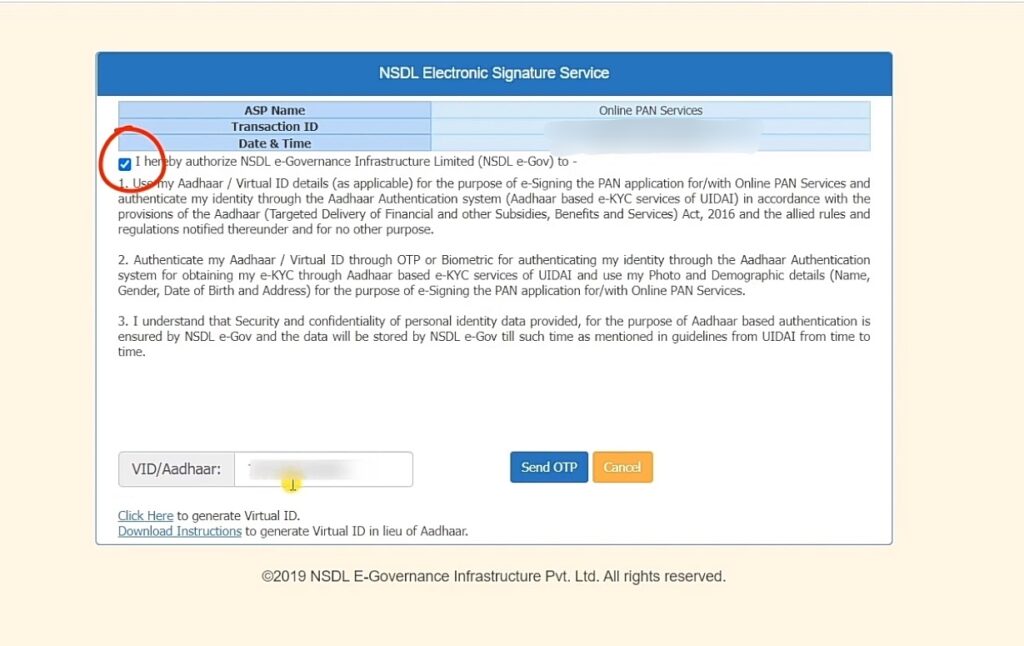

Step 17 : accept the terms and conditions by ticking the box. Enter your Aadhaar number and click on ‘Send OTP’

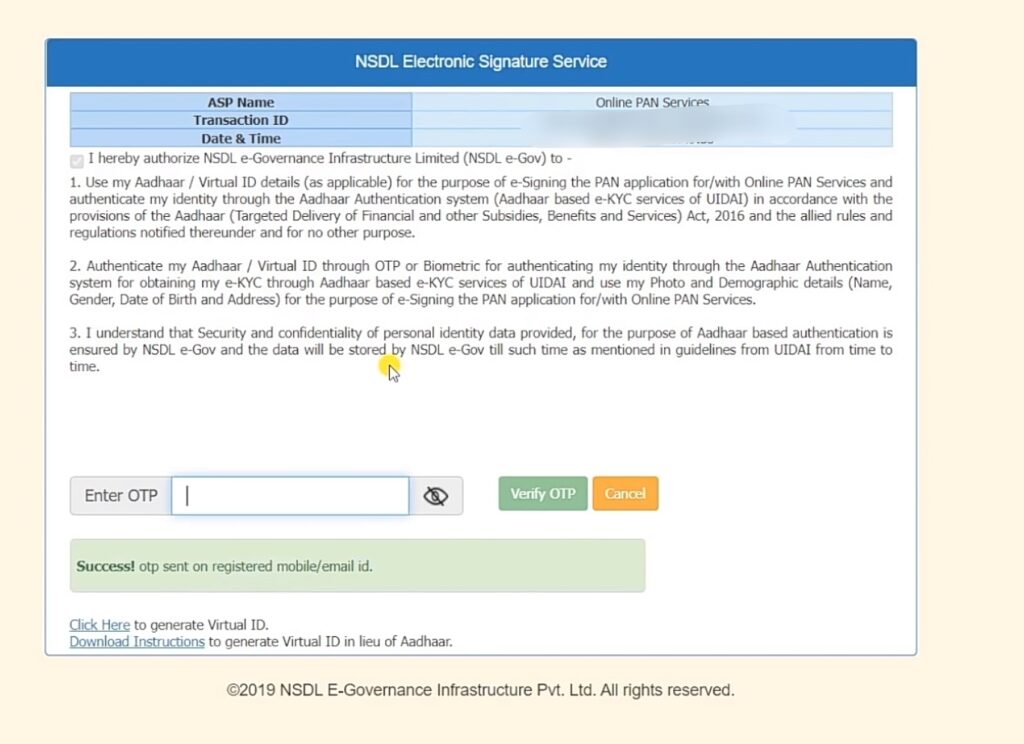

Step 18 : Enter the OTP sent to your Aadhaar Registered mobile number and verify. You can now download the acknowledgement form. The password to open this file is your date of birth in the format DD/MM/YYYY.

How to update a PAN card on UTIITSL portal?

Step 1 : Please visit or open UTIITSL portal.

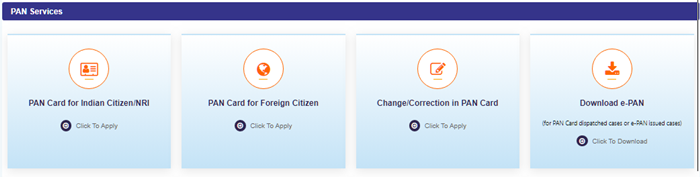

Step 2 : Click on the ‘Click to Appy’ under the ‘Change/Correction in PAN Card’ tab.

Step 3 : Click the ‘Apply for Change/Correction in PAN card details’ tab.

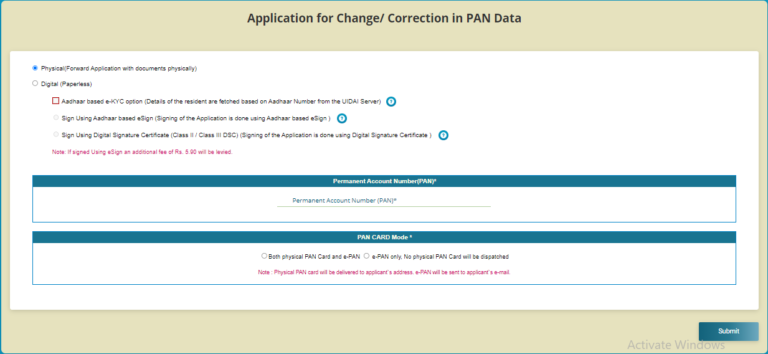

Step 4: after Selecting the mode of submission of documents, enter your PAN number, and then select the PAN card mode and click the ‘Submit’ button.

Step 5: Once the request is registered, you will receive a reference number. Click on ‘OK’.

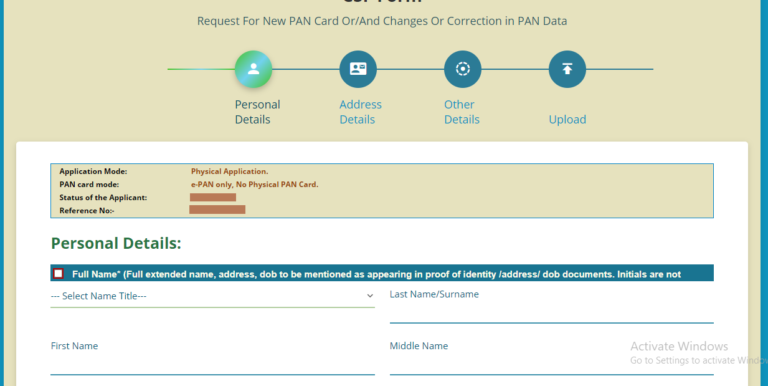

Step 6: Enter Pan card Holder name and address and click on the ‘Next Step’ button.

Step 7: Enter the PAN card number and verification and click the ‘Next Step’ button.

Step 8: Upload the documents and click the ‘Submit’ button.

The time taken for the processing of a PAN (Permanent Account Number) card application can vary depending on various factors, including the efficiency of the processing authorities and the accuracy of the application details provided. Generally, it takes around 15 to 25 working days for a PAN card application to be processed and for the card to be delivered to the applicant’s address. However, please note that these timelines are indicative and can be subject to change. It is advisable to check with the concerned authorities or the PAN card application service provider for the most up-to-date information and any specific requirements.

How to update PAN offline ?

To update your PAN offline, you will need to follow these simple steps:

1. Download the PAN correction form from the website of either NSDL or UTI.

2. Fill out the form with the updated information for your PAN.

3. Attach a copy of your current PAN card, proof of identity, and proof of address with the form.

4. Submit the form and documents to your nearest NSDL or UTI branch office. PAN Centres Near Your Location

5. Once submitted, you will receive an acknowledgement of your request.

6. The updated PAN card with your new information will be sent to your address within a few weeks.

It’s important to ensure that all information provided is accurate, as discrepancies can lead to issues later on. Pan card updates can also be done online through the NSDL or UTI websites and may be a faster option for some.

Documents Required to Change PAN Card Details :

To change PAN card details, you typically need to submit the following documents:

PAN card correction application form: You will need to fill out and submit the PAN card correction application form. The form can be obtained from the official website of the income tax department or the UTIITSL or NSDL websites.

Proof of identity: You will need to provide a document that serves as proof of your identity. Acceptable documents include Aadhaar card, passport, driving license, voter ID card, etc.

Proof of address: You will need to provide a document as proof of your current address. Acceptable documents include Aadhaar card, passport, driving license, voter ID card, utility bills (electricity bill, telephone bill, etc.), bank statement, etc.

Proof of date of birth: If you need to change your date of birth on the PAN card, you will need to provide a document as proof of your date of birth. Acceptable documents include birth certificate, school leaving certificate, passport, etc.

Proof of change requested: If you are changing any specific details on the PAN card, such as name, father’s name, etc., you may need to provide supporting documents as proof of the change requested. For example, a marriage certificate can be submitted as proof of name change due to marriage.

It’s important to note that the specific requirements may vary depending on the nature of the change and the issuing authority. It’s advisable to check the official websites or contact the relevant authorities (such as the income tax department or UTIITSL/NSDL) to get accurate and up-to-date information regarding the required documents for changing PAN card details.

Fees for PAN card update or correction

- If communication address is within India, then the fee for processing PAN application is ₹ 110 (₹ 93 + 18% Goods And Service Tax).

Demand Draft

Credit Card / Debit Card

Net BankingIf any of addresses i.e. office address or residential address is a foreign address, the payment can be made only through credit card/debit card or demand draft payable at Mumbai.

If communication Address is outside India, then the fee for processing PAN application is ₹ 1020 [(Application fee ₹ 93 + Dispatch Charges ₹ 771.00) + 18% Goods And Service Tax].

FAQS

How to change address in PAN card ?

Address on PAN card can be changed by making an application either online or offline. Refer to the step-by-step guide mentioned above. Also, note that address is not mentioned on the PAN card (it cannot be used as address proof). read our full blog post

How to check PAN card change status ?

You can check the status of your PAN card correction application online by following the below process:

- Go to the NSDL PAN website or the UTIITSL website.

- Click the ‘Know Status of PAN application’ or ‘Track PAN card’ option.

- Enter the ‘Acknowledgement Number’ and Captcha code and click ‘Submit’.

The status of the PAN card change application will be displayed on the screen.

How to download updated PAN card ?

You can check the status of your PAN card correction application online by following the below process:

- Go to the NSDL PAN website or the UTIITSL website.

- Click the ‘Download e-PAN/ e-PAN XML’ option.

- Enter the PAN number, date of birth, GSTIN (if applicable) and Captcha code and click ‘Submit’.

Your e-PAN card will get downloaded or the link to download the e-PAN will be sent to your email through which you can download it.